Matrixport Raises $100M and Hits Unicorn Status with $1B Valuation

The two-year-old company was launched in 2019 by Bitmain co-founders Jihan Wu and Ge Yuesheng and has raised $129 million to date.

key takeaways

- As of March 2021, the company had over $10 billion in assets under management and custody and over $5 billion in average monthly trading volumes across its products, it said.

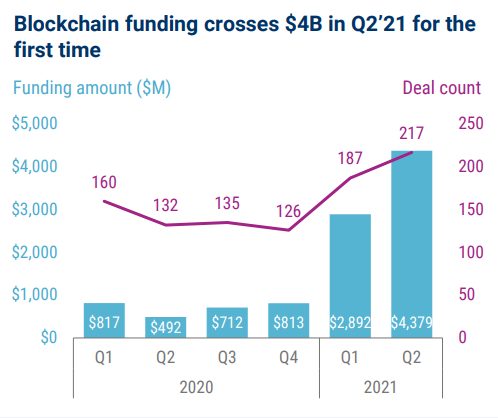

- The number of crypto-deals in the second quarter of this year has increased over 64% from the year-ago quarter, with blockchain funding crossing the $4 billion mark during this quarter for the first time ever, according to data from CB Insights.

Singapore-based crypto financial service platform Matrixport announced it closed its $100 million Series C funding round with a valuation over $1 billion, the company said in a statement.

The two-year-old company was launched in 2019 by Bitmain co-founders Jihan Wu and Ge Yuesheng and has raised $129 million to date. Its products include institutional custody, trading, lending, structured products and asset management to institutional investors and retail customers.

As of March 2021, the company had over $10 billion in assets under management and custody and over $5 billion in average monthly trading volumes across its products, it said.

The company reached unicorn status with its latest funding round, adding it to a list of over 900 companies with valuations of $1 billion or greater, according to data on the Crunchbase Unicorn Board. In late July, the first non-fungible token (NFT) marketplace OpenSea also reached unicorn status after raising $100 million in a Series B funding round led by a16z, which brought its valuation to $1.5 billion, Blockworks previously reported. These two crypto-companies are some of the latest organizations to join the growing list of unicorns in the global marketplace.

“I always believe an open and permissionless blockchain ecosystem is the bedrock of a new financial network that will benefit a large part of the world’s population,” Wu said. “As a result, there will be hundreds of trillions of value created, stored and transferred on this new financial network,” he added.

This investment round was led by partners of DST Global, C Ventures and K3 Ventures. Other participants include Qiming Venture Partners, CE Innovation Capital, Tiger Global, Cachet Group, Palm Drive Capital, Foresight Ventures and A&T Capital, along with earlier investors Lightspeed, Polychain, Dragonfly Capital, CMT Digital and IDG Capital.

The funding will be used to further invest in research and development to improve its product offerings and security for a better user experience, it said. The funds will also be used to support global expansion and secure licenses to operate in more jurisdictions to allow more users globally to use its platform. Although the company is based in Singapore, it currently has licenses in Hong Kong and Switzerland and serves institutions and retail investors in Asia and Europe.

In general, there has been a large influx of investments and deals being closed in the crypto space. The number of crypto-deals in the second quarter of this year has increased over 64% from the year-ago quarter, with blockchain funding crossing the $4 billion mark during this quarter for the first time ever, according to data from CB Insights.

“As blockchain based digital assets gain wider adoption and acceptance, new pathways are needed to capture yield, source liquidity and manage crypto assets as an emerging asset class,” said Adrian Cheng, an investor in the round and founder of C Ventures and CEO of New World Group.

In 2020, Bloomberg reported that the company was seeking to raise $40 million in a funding round with a valuation of $300 million. In 2019, the startup took in around $8 million in revenue and expected to more than double that in 2020, according to a slide deck shared with investors and viewed by Bloomberg.