ETH Outperforms BTC as the Market Attempts Recovery: Markets Wrap

ETH continues to outperform BTC as the digital asset market attempts a recovery, ETH market structure looks bullish

Blockworks Exclusive Art by axel rangel

key takeaways

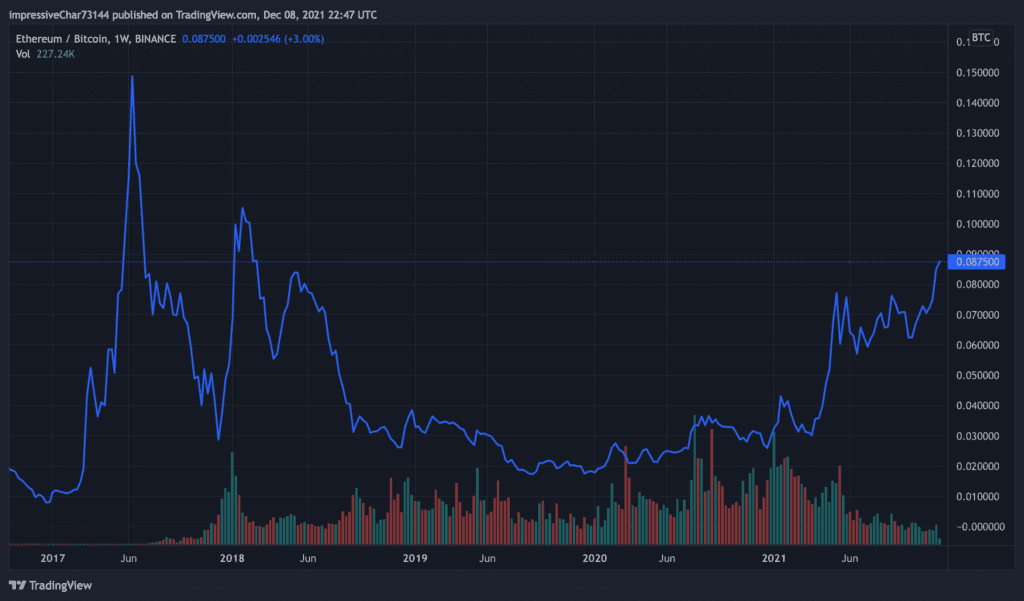

- The ETH-to-BTC ratio has been trending upwards as ETH gains momentum

- ETH market structure implies bullish price action could be nearing

ETH continues to outperform BTC as the digital asset market recovers from last weekend’s sell-off.

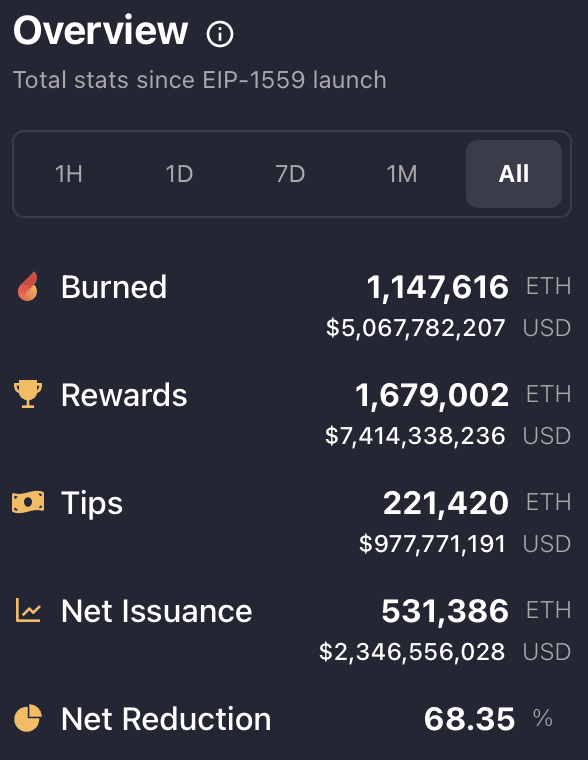

ETH issuance continues to decline post-EIP-1559 implementation.

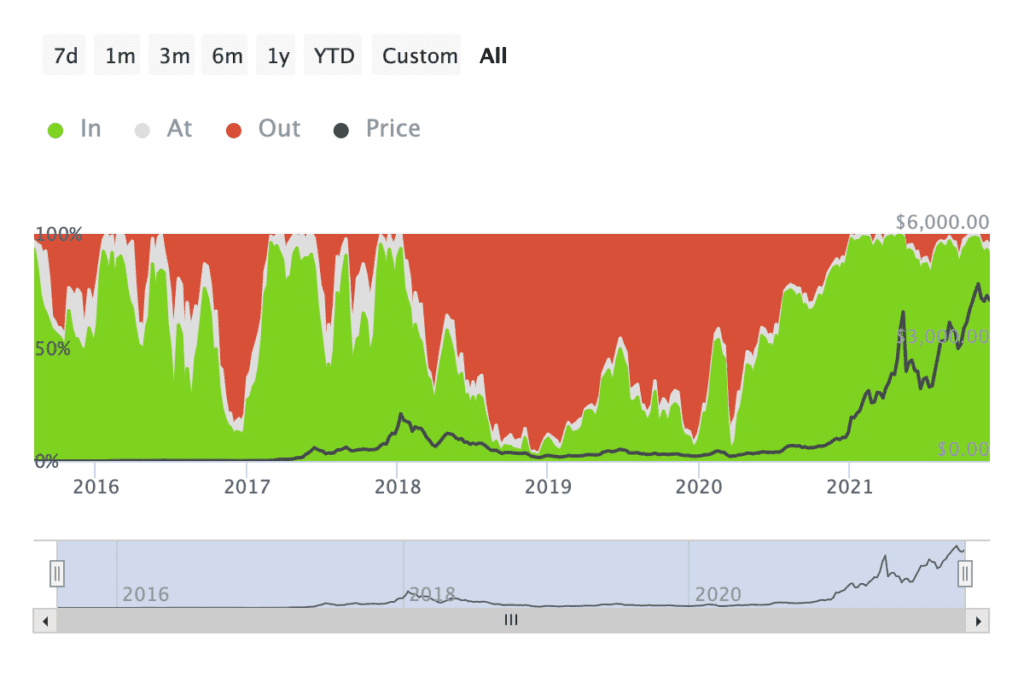

92% of all Ethereum addresses are in a state of profit.

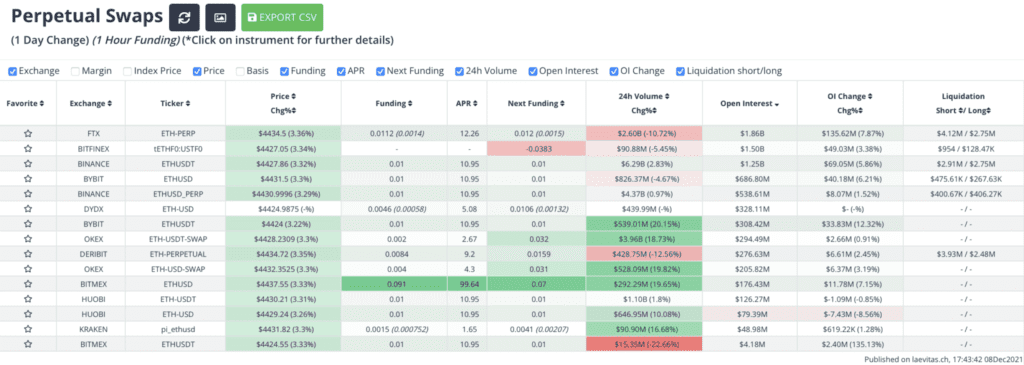

Perpetual funding rates show relatively neutral sentiment among traders, except for Bitmex where traders are getting aggressive.

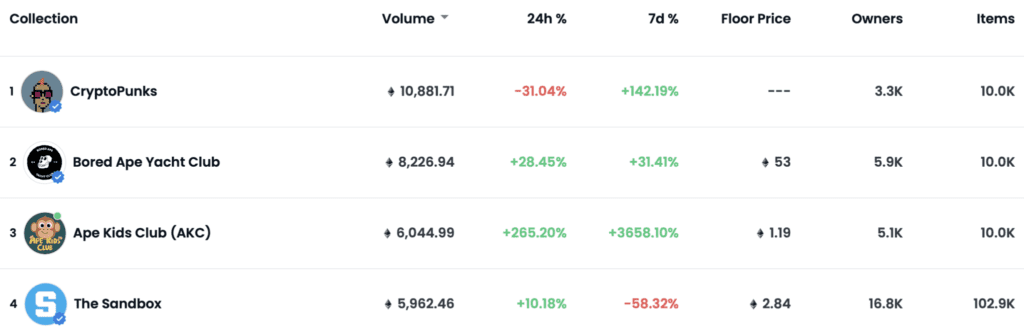

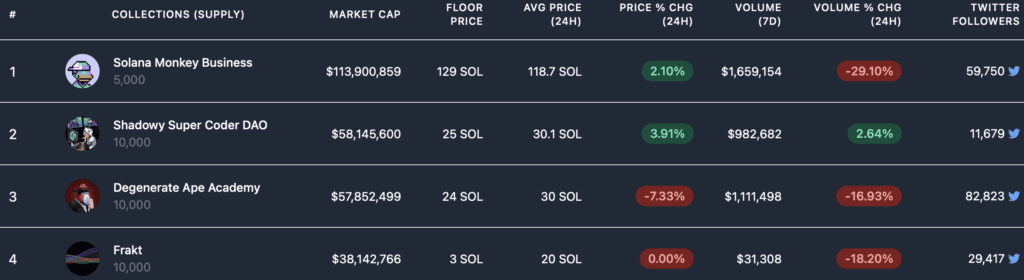

A look into the latest prices for top NFT collections.

Latest in Macro:

- S&P 500: 4,701, +0.31%

- NASDAQ: 15,786, +0.64%

- Gold: $1,783, -0.04%

- WTI Crude Oil: $72.65, +0.83%

- 10-Year Treasury: 1.528%, +0.048%

Latest in Crypto:

- BTC: $50,174, -0.39%

- ETH: $4,384, +2.42%

- ETH/BTC: 0.0874, +2.63%

- BTC.D: 40.56%, -1.42%

Ethereum

ETH continues to outperform BTC as the digital asset market recovers from last weekend’s sell-off. The ETH/BTC ratio has broken out of a multi-month range after firmly breaking out over the .08 level on Dec. 4. The trend has continued and is running toward levels not seen since early 2018.

Source: Trading View

Source: Trading ViewEthereum issuance has fallen since the implementation of EIP-1559 back in August. 1.147 million ETH has been burned over that period, leading to a net reduction of 68.35%, according to data from watchtheburn.com.

Source: watchtheburn.com

Source: watchtheburn.com61.52 million addresses holding ETH, or 92% of all addresses, are in a state of profit according to data from intotheblock.com.

Source: Intotheblock.com

Source: Intotheblock.com

Perpetual funding rates for ETH hold a slightly positive bias across all exchanges, except for Bitmex where traders are getting a bit aggressive according to data from laevitas.ch. The higher the funding rate, the more expensive it is for longs to keep positions open.

Source: Laevitas.ch

Source: Laevitas.chA Genesis report noted some layer-2 developments over the month of November include:

- Metis, an Optimism fork that allows data to be stored on IPFS, launched a $100 million ecosystem fund at the beginning of the month22.

- And StarkWare, which relies on a different layer-2 technology (ZK rollups), raised $50 million at a $2 billion valuation23 to accelerate expansion of the network.

Non-Fungible Tokens (NFTs)

Trading data from OpenSea and Solanalysis of some of the top Solana and Ethereum projects can be found below:

Top Ethereum Projects

Top Ethereum Projects Top Solana Projects

Top Solana Projects If you made it this far, thanks for reading! I am looking forward to catching up on tomorrow.

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.