Cheatsheet: Ethereum sees net validator outflow for first time in 6 weeks

Ether isn’t exactly close to record highs, but some validators are still making a move

lagano/Shutterstock modified by Blockworks

This is Cheatsheet, a primer on what’s happening in crypto today.

Markets have rotated from AI to dog coins and now back to AI, all in the same month.

Fetch.ai (FET), Render (RNDR), SingularityNET (AGIX) lead top cryptocurrencies over the past day, with each rallying between 33% and 35% as of 7:30 am ET.

All three tokens power marketplaces for decentralized computing power, which have captured imaginations ever since ChatGPT made generative AI a household term last year.

Memecoins fell the most, with pepe (PEPE), bonk (BONK), dogwifhat (WIF) and shiba inu (SHIB) losing more than 15%. (Memecoins are still the best performers over the past week.)

Bitcoin (BTC) traded flat while ether (ETH), still more than 20% below its all-time high, slipped 2.3% to below $3,800.

On-chain mail

All eyes are on Ethereum after bitcoin briefly hit all-time highs earlier this week — as a subset of validators pull their ETH from the chain.

- There were slightly more validators exiting the Ethereum blockchain than joining yesterday, a first since late January.

- Total ETH staked dropped by more than 2% overnight, or more than 670,000 ETH ($2.54 billion).

- Ethereum’s staking APR has risen from below 3.5% to 3.69% since the start of the month.

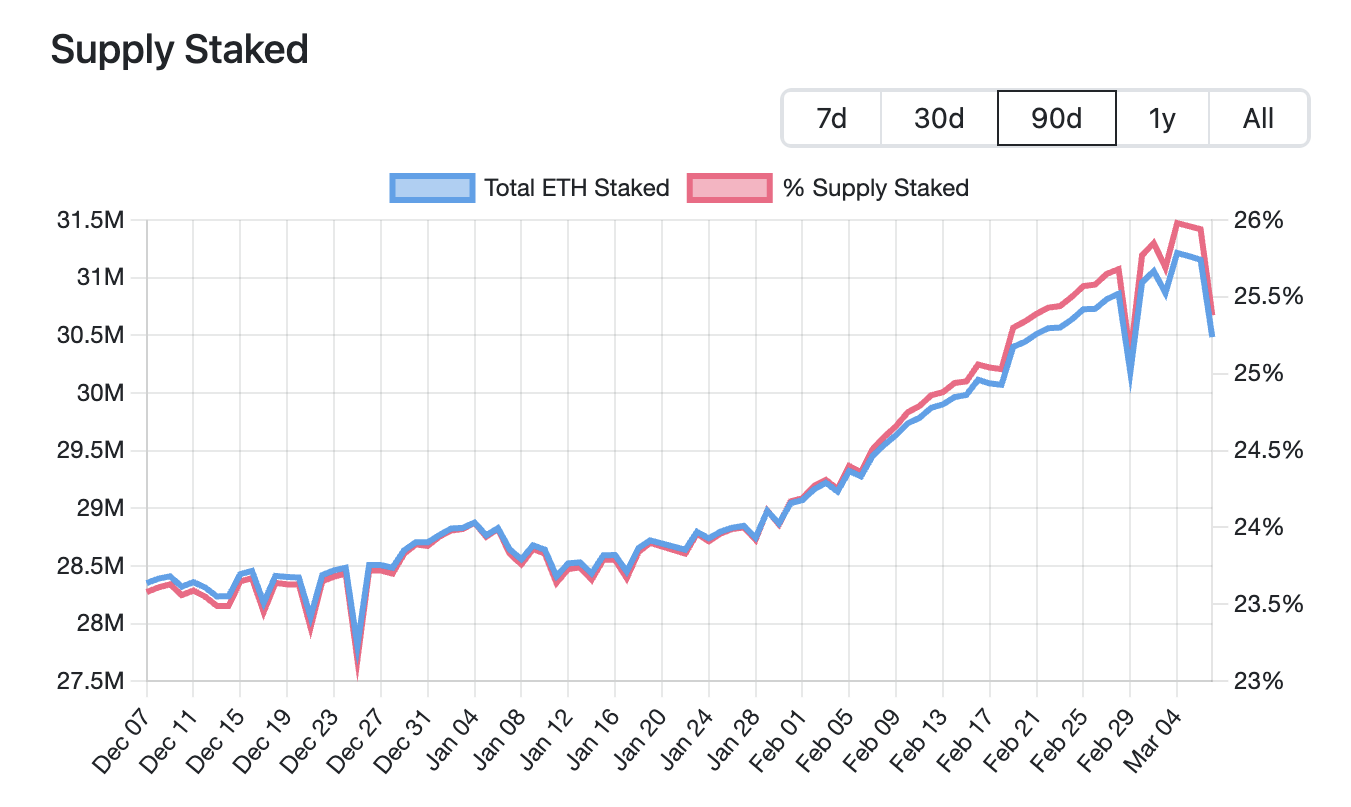

Still, ETH staking has exploded over the past year, from about 15% of the supply to as much as 26% earlier this week (now back to just above one quarter).

About 40% of all ETH staked (12.16 million ETH worth $46.2 billion) is with liquid staking protocols like Lido and Rocket Pool — up from 10.84 million ETH at the start of the year (under 38% of total ETH stake).

New restaking apps like EigenLayer allow users to unlock additional rewards on their staking tokens. The amount of ETH in EigenLayer has popped 75% since January, from 1.7 million ETH to almost 3 million ETH right now.

- There’s 4.3 million ETH ($16.25 billion) in restaking apps overall, about 14% of the total ETH stake and over one-third of what’s in liquid staking platforms.

- EigenLayer has sent users almost 2.4 billion points to date, part of an incentive system for future airdrops.

- Those points are selling for more than $0.15 per unit on Whales Market, effectively valuing the EigenLayer points market at nearly $360 million.

The ETH supply staked is more volatile since prices went up (source)

The ETH supply staked is more volatile since prices went up (source)

Crypto business

Stocks across the crypto space found their footing Wednesday alongside bitcoin.

- Bitfury-owned miner Cipher Mining surged more than 27% and held onto most of those gains after hours, propelled by strong Q4 earnings.

- MicroStrategy rallied 18.5% throughout the day — rounding out a 160% pump over the past month.

MicroStrategy’s surge came in response to its upsizing of a fresh convertible debt offering, from $600 million to $700 million (you guessed it — it plans to buy more bitcoin with it).

MicroStrategy is up more than 100% on its bitcoin to date.

The firm already has $2.6 billion in liabilities after multiple rounds of corporate bond sales going back to 2021.

Total common shares outstanding for MSTR has nearly doubled across that period, from 7.623 million shares in December 2020 to 14.904 million at the end of last year.

- Not that markets seem to mind, MSTR’s share price is up 750% since then.

- Coinbase’s common share count has grown 38% since it went public in April 2021.

- COIN has meanwhile swelled its cash pile from $4 billion to $5.71 billion per its latest disclosure.

On the ground

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.

- Empire: Crypto news and analysis to start your day.

- Forward Guidance: The intersection of crypto, macro and policy.

- The Drop: Apps, games, memes and more.

- Lightspeed: All things Solana.

- Supply Shock: Bitcoin, bitcoin, bitcoin.